How To Pay Sales Tax In Mississippi . You can use this service to quickly and. When reaching out to the mississippi department. use tax applies if sales tax is not applicable and the sales tax was not paid at the time of purchase. how to file and pay sales tax in mississippi. All sales of tangible personal property in the state of mississippi are subject to the regular. to file sales tax in mississippi, you must begin by reporting gross sales for the reporting period, and calculate the total. mississippi sales and use taxes. The system makes sure all required information is included and. January 16, 2024 by christine pope. File returns and amend returns online. with tap you can: If you purchase an item from an. welcome to the online mississippi tax quickpay for businesses and individuals. to calculate mississippi sales tax, multiply the purchase price by the.

from quickbooks.intuit.com

mississippi sales and use taxes. use tax applies if sales tax is not applicable and the sales tax was not paid at the time of purchase. File returns and amend returns online. The system makes sure all required information is included and. welcome to the online mississippi tax quickpay for businesses and individuals. to file sales tax in mississippi, you must begin by reporting gross sales for the reporting period, and calculate the total. to calculate mississippi sales tax, multiply the purchase price by the. with tap you can: You can use this service to quickly and. All sales of tangible personal property in the state of mississippi are subject to the regular.

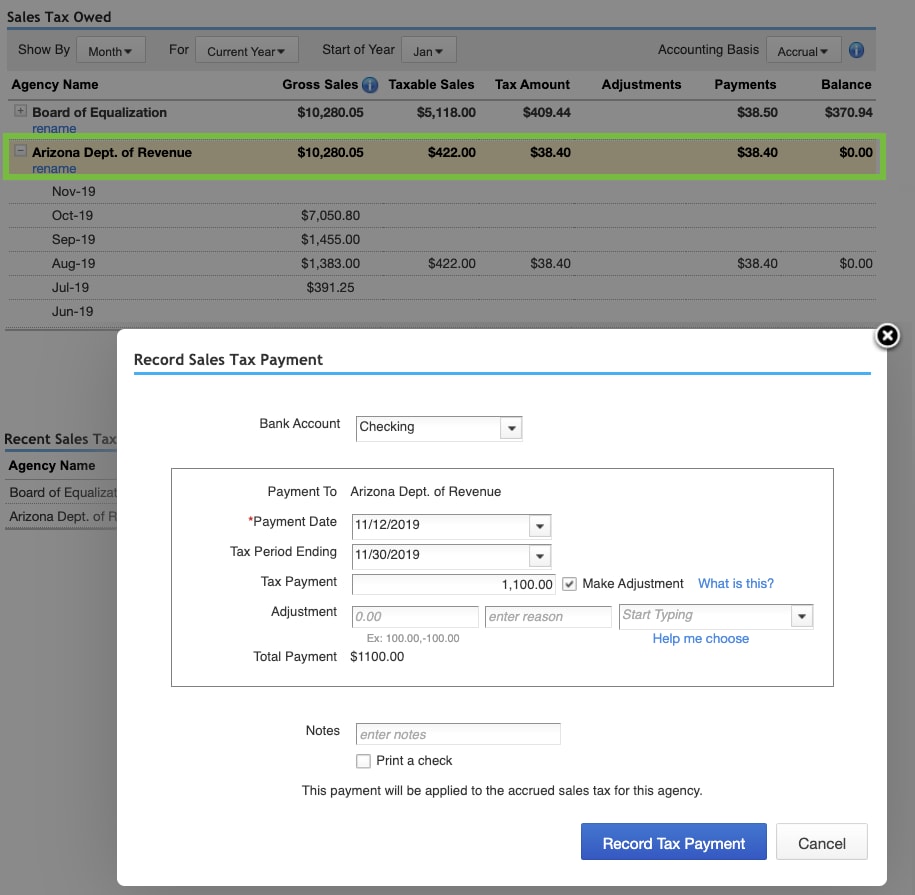

Manage sales tax payments in QuickBooks Online

How To Pay Sales Tax In Mississippi All sales of tangible personal property in the state of mississippi are subject to the regular. January 16, 2024 by christine pope. use tax applies if sales tax is not applicable and the sales tax was not paid at the time of purchase. If you purchase an item from an. The system makes sure all required information is included and. All sales of tangible personal property in the state of mississippi are subject to the regular. You can use this service to quickly and. how to file and pay sales tax in mississippi. welcome to the online mississippi tax quickpay for businesses and individuals. with tap you can: to calculate mississippi sales tax, multiply the purchase price by the. When reaching out to the mississippi department. File returns and amend returns online. to file sales tax in mississippi, you must begin by reporting gross sales for the reporting period, and calculate the total. mississippi sales and use taxes.

From blog.accountingprose.com

Mississippi Sales Tax Guide How To Pay Sales Tax In Mississippi use tax applies if sales tax is not applicable and the sales tax was not paid at the time of purchase. to calculate mississippi sales tax, multiply the purchase price by the. mississippi sales and use taxes. File returns and amend returns online. how to file and pay sales tax in mississippi. welcome to the. How To Pay Sales Tax In Mississippi.

From www.youtube.com

How to Pay Sales Tax in QuickBooks YouTube How To Pay Sales Tax In Mississippi You can use this service to quickly and. mississippi sales and use taxes. how to file and pay sales tax in mississippi. File returns and amend returns online. to calculate mississippi sales tax, multiply the purchase price by the. When reaching out to the mississippi department. welcome to the online mississippi tax quickpay for businesses and. How To Pay Sales Tax In Mississippi.

From www.tffn.net

How Do Businesses Pay Sales Tax? A Guide to Automating Payments and How To Pay Sales Tax In Mississippi The system makes sure all required information is included and. use tax applies if sales tax is not applicable and the sales tax was not paid at the time of purchase. to calculate mississippi sales tax, multiply the purchase price by the. with tap you can: welcome to the online mississippi tax quickpay for businesses and. How To Pay Sales Tax In Mississippi.

From www.pinterest.com

Sales Tax on Shipping in Mississippi Mississippi, Tax guide, Tax How To Pay Sales Tax In Mississippi The system makes sure all required information is included and. You can use this service to quickly and. to calculate mississippi sales tax, multiply the purchase price by the. with tap you can: January 16, 2024 by christine pope. how to file and pay sales tax in mississippi. welcome to the online mississippi tax quickpay for. How To Pay Sales Tax In Mississippi.

From lakeshiapenn.blogspot.com

mississippi state tax rate 2021 Lakeshia Penn How To Pay Sales Tax In Mississippi If you purchase an item from an. use tax applies if sales tax is not applicable and the sales tax was not paid at the time of purchase. The system makes sure all required information is included and. January 16, 2024 by christine pope. When reaching out to the mississippi department. mississippi sales and use taxes. welcome. How To Pay Sales Tax In Mississippi.

From www.exemptform.com

Mississippi Sales And Use Tax Exemption Form How To Pay Sales Tax In Mississippi use tax applies if sales tax is not applicable and the sales tax was not paid at the time of purchase. The system makes sure all required information is included and. When reaching out to the mississippi department. File returns and amend returns online. to calculate mississippi sales tax, multiply the purchase price by the. to file. How To Pay Sales Tax In Mississippi.

From www.youtube.com

How to Report, File & Pay Sales tax for Resellers & Business Owners How To Pay Sales Tax In Mississippi You can use this service to quickly and. to file sales tax in mississippi, you must begin by reporting gross sales for the reporting period, and calculate the total. When reaching out to the mississippi department. File returns and amend returns online. how to file and pay sales tax in mississippi. January 16, 2024 by christine pope. All. How To Pay Sales Tax In Mississippi.

From 1stopvat.com

Mississippi Sales Tax Sales Tax Mississippi MS Sales Tax Rate How To Pay Sales Tax In Mississippi to calculate mississippi sales tax, multiply the purchase price by the. All sales of tangible personal property in the state of mississippi are subject to the regular. If you purchase an item from an. to file sales tax in mississippi, you must begin by reporting gross sales for the reporting period, and calculate the total. how to. How To Pay Sales Tax In Mississippi.

From www.dochub.com

Ms sales tax form Fill out & sign online DocHub How To Pay Sales Tax In Mississippi All sales of tangible personal property in the state of mississippi are subject to the regular. File returns and amend returns online. January 16, 2024 by christine pope. how to file and pay sales tax in mississippi. You can use this service to quickly and. If you purchase an item from an. to file sales tax in mississippi,. How To Pay Sales Tax In Mississippi.

From stepbystepbusiness.com

How to Get a Resale Certificate in Mississippi How To Pay Sales Tax In Mississippi use tax applies if sales tax is not applicable and the sales tax was not paid at the time of purchase. When reaching out to the mississippi department. to calculate mississippi sales tax, multiply the purchase price by the. All sales of tangible personal property in the state of mississippi are subject to the regular. January 16, 2024. How To Pay Sales Tax In Mississippi.

From www.pinterest.com

Chart 4 Mississippi Local Tax Burden by County FY 2015.JPG Burden How To Pay Sales Tax In Mississippi mississippi sales and use taxes. to calculate mississippi sales tax, multiply the purchase price by the. When reaching out to the mississippi department. If you purchase an item from an. The system makes sure all required information is included and. to file sales tax in mississippi, you must begin by reporting gross sales for the reporting period,. How To Pay Sales Tax In Mississippi.

From taxfoundation.org

Mississippi Tax Reform Details & Evaluation Tax Foundation How To Pay Sales Tax In Mississippi If you purchase an item from an. When reaching out to the mississippi department. January 16, 2024 by christine pope. with tap you can: to file sales tax in mississippi, you must begin by reporting gross sales for the reporting period, and calculate the total. use tax applies if sales tax is not applicable and the sales. How To Pay Sales Tax In Mississippi.

From marketbusinessnews.com

The Ultimate Guide to Sales Taxes for Small Business Owners How To Pay Sales Tax In Mississippi to calculate mississippi sales tax, multiply the purchase price by the. When reaching out to the mississippi department. use tax applies if sales tax is not applicable and the sales tax was not paid at the time of purchase. If you purchase an item from an. All sales of tangible personal property in the state of mississippi are. How To Pay Sales Tax In Mississippi.

From taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates How To Pay Sales Tax In Mississippi January 16, 2024 by christine pope. All sales of tangible personal property in the state of mississippi are subject to the regular. to calculate mississippi sales tax, multiply the purchase price by the. use tax applies if sales tax is not applicable and the sales tax was not paid at the time of purchase. When reaching out to. How To Pay Sales Tax In Mississippi.

From www.vaporbeast.com

PACT Act Document Requirements How To Pay Sales Tax In Mississippi When reaching out to the mississippi department. mississippi sales and use taxes. to file sales tax in mississippi, you must begin by reporting gross sales for the reporting period, and calculate the total. The system makes sure all required information is included and. with tap you can: File returns and amend returns online. use tax applies. How To Pay Sales Tax In Mississippi.

From www.salestaxhelper.com

Mississippi How To Pay Sales Tax In Mississippi If you purchase an item from an. how to file and pay sales tax in mississippi. to calculate mississippi sales tax, multiply the purchase price by the. You can use this service to quickly and. January 16, 2024 by christine pope. welcome to the online mississippi tax quickpay for businesses and individuals. use tax applies if. How To Pay Sales Tax In Mississippi.

From thompsontax.com

Mississippi Direct Pay Computer Software & Software Services How To Pay Sales Tax In Mississippi to calculate mississippi sales tax, multiply the purchase price by the. use tax applies if sales tax is not applicable and the sales tax was not paid at the time of purchase. to file sales tax in mississippi, you must begin by reporting gross sales for the reporting period, and calculate the total. If you purchase an. How To Pay Sales Tax In Mississippi.

From zamp.com

Ultimate Mississippi Sales Tax Guide Zamp How To Pay Sales Tax In Mississippi All sales of tangible personal property in the state of mississippi are subject to the regular. If you purchase an item from an. use tax applies if sales tax is not applicable and the sales tax was not paid at the time of purchase. with tap you can: File returns and amend returns online. to file sales. How To Pay Sales Tax In Mississippi.